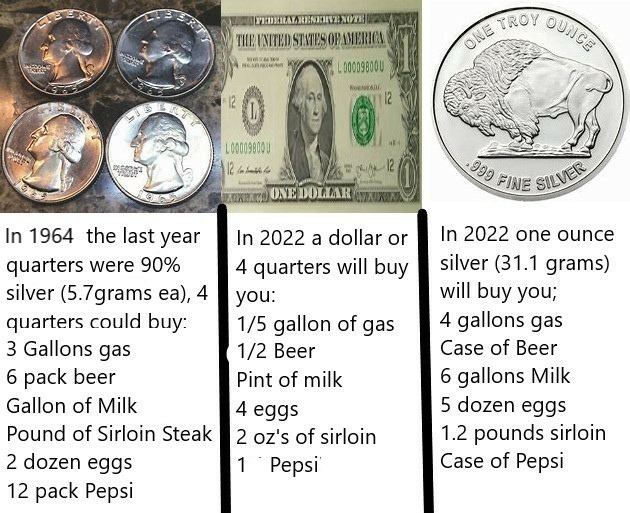

Have you seen this one going around? I don't recall where I got it.

It's approximately right, but where it's wrong is embedded right there in the

text; it's just hard to see directly. Note that in the left panel, it says a dollar was four 5.7 gram quarters or 22.8 grams of silver. In the last column it compares what 22.8 grams of silver bought in 1964 to what 31.1 grams buys today which seems to imply the dollar was that 31.1 grams of silver. It's not that it's a nonsensical comparison, it's just that the right column is 36% more silver than the 22.8 grams of silver in the left column, so it's like comparing a 1964 dollar to $1.36. Note that the increased amount of stuff that 36% more silver buys isn't necessarily 36% more of every item, but none of the handful of things they track actually cost more in silver today than in 1964, so their real prices have gone down.

Some years ago, I weighed four pre-1964 quarters on a reloading powder scale and determined they weighed 25 grams. 90% of that was 22.5 grams - it could be the scale was wrong and it could be the coins were worn a bit from being in circulation. After all 3/10 of a gram isn't much, unless you're buying gemstones where it's 1-1/2 carats. (There's a side trip here into Troy ounces - as silver is weighed in - versus common or avoirdupois ounces and I'm going to studiously avoid this.) This went into a spreadsheet where I can tell you what today's value for $1 face value of silver works out to be. With a spot price at the moment of $20.68 per ounce, four of those 90% silver quarters are worth $14.96. Which, of course, means a 90% silver dime is worth $1.50 ($1.496).

The point though is that the dollar has lost its value not that things are more expensive. The dollar buys less because it's worth less - and well on the way to worthless. If you bought things by weight in silver, most prices have gone down.

For the life of this blog, I've been saying that the creation of more money, "monetary stimulation" is going to lead to economic collapse. I've talked about returning to a gold standard many times and I've stressed that it doesn't have to be gold, or silver or the giant stones the people on Yap Island used, but money can't be based on fiat - literally "it's worth something because I say so." Where "I" is the Federal Reserve. There are times I think the entire Federal Government is owned and controlled by the Federal Reserve Banks and not the other way around.

There's an old saying that value of paper money always - always - returns to its intrinsic value, the value of the paper it's printed on. Pretty much zero. Toilet paper? The toilet paper is more valuable, but the fiat bucks will work. The trap that the Fed finds itself in now is that since they've created trillions of dollars, every additional dollar they create is worth less than the one before it (called the marginal utility function). That means they need to create even more trillions to really have an effect. They can raise interest rates to try to crash the economy, but those are words nobody wants to hear. Eventually - I can't tell you when - it has to collapse and the dollar return to the value of paper it's printed on. Or the value of the memory cell in a DRAM module where it exists. It's not actually zero, but it's in the same neighborhood.

Inflation has always been an attractive option for people in power. Since the commies siezed power they have taken inflation to new levels.... deliberately. They are happily embracing Lenin's admonition to grind us between the millstones of taxation and inflation.

ReplyDeleteThey have stolen our ability to be prosperous. In the sixties my grandpa had a little 13 stool snack bar in a grocery store. He worked alone. From the time I was four till I was eleven, he had a bedroom added, got gutters, built a nice roomy two car garage, went from a mid forties Pontiac to a newish Buick for her and a pickup for him, bought himself a few horses and me a Welsh pony, and then

ReplyDeleteHe bought himself a country store between Houston and Humble.

All from a little burger stand in the foyer of Epps supermarket in Houston.

He was not a genius. He put in the hours and did a solid job, and prosperity wasn't so elusive then.

If you don't surrender enough fiat dollars on April 15th, government employees will kill you. Dollars are extortion futures.

ReplyDeleteGeorge Washington led an army to squash the https://en.wikipedia.org/wiki/Whiskey_Rebellion , because rebels were turning their cereals into alcohol and using that alcohol as money. That army's officers were sons of Eastern Seaboard families, and preferred the peasants to use fiat notes which were a debt to the Eastern Seaboard families.

I don't know what the interest rate was, but suppose the fiat of Washington's time required 2%/year paid as interest. Price tags are adjusted so that fiat represents the entirety of liquid transactions, the GDP. After the first year, the bankers own 2% of the GDP and the peasants own 98%. After ten years, the bankers own 20% of the GDP which is a controlling interest.

Are you going to tell me that George Washington and the other founding lawyers were too dumb to understand this? Blah blah blah, John Locke quotes, bill of rights, we'll say anything to get the peasants to sell themselves into slavery into us. Why, I've already got this cutie Sally right here, inherited her from my father in law, and she knows how the world works.

Of course the founders knew about the dangers of a central bank. Quotes are all we have to use as illustrations:

ReplyDelete“All the perplexities, confusion and distress in America arise, not from defects in their Constitution or Confederation, not from want of honor or virtue, so much as from the downright ignorance of the nature of coin, credit, and circulation.” John Adams

“I wish it were possible to obtain a single amendment to our constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its constitution; I mean an additional article, taking from the federal government the power of borrowing.”

Thomas Jefferson, Letter to John Taylor, November 26, 1798

“And I sincerely believe with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.” Thomas Jefferson to John Taylor, 1816

“Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” George Washington to J. Bowen 1787

Not to mention that Article 1 section 10 of the US Constitution says:

DeleteNo State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility. (Clearly back when states issued their own money)

And the Coinage Act of 1792 said that debasing any gold or silver coin to make it less valuable than it should be was punishable by death: "That if any of the gold or silver coins which shall be struck or coined at the said mint shall be debased or made worse as to the proportion of fine gold or fine silver therein contained, or shall be of less weight or value than the same ought to be pursuant to the directions of this act, through the default or with the connivance of any of the officers or persons who shall be employed at the said mint, for the purpose of profit or gain, or otherwise with a fraudulent intent, and if any of the said officers or persons shall embezzle any of the metals which shall at any time be committed to their charge for the purpose of being coined, or any of the coins which shall be struck or coined at the said mint, every such officer or person who shall commit any or either of the said offences, shall be deemed guilty of felony, and shall suffer death.” –Chap. 16 , Section 19

Add in that the history of "paper money always returns to the value of the paper" goes back at least a thousand years before the US constitution. It's clear that the founders knew the problems that lay down that road and really didn't want central banks controlling the money supply.

And while the constitution says all those things that point out Exactly what the economy is supposed to be based on, the Supreme Court said the federal Reserve is constitutional. Or so I've been told. And I'm certainly not believing it is.

DeleteStudying the events on Jekyll Island, the people who were there, the sneaky crap they did just to get there and not accidentally alert the rubes to the fact that A Game was afoot,, it's worth reading about, to see the names. Bankers designed it and electeds applauded it and jammed it through while people were off on Christmas break, IIRC. I'm certain it was done in a brilliantly underhanded manner.

The people have been needing to put rope to work for a very long time.

Divemedic,

Deletequotes of the Founders are not all. There is the fact that establishment of a central bank was forestalled as long as it was. There were at least three attempts before the end of Jefferson's presidential term.

Those three are only what I recall this moment, I suspect there were other attempts.

On the boots on the ground level the Fed and its bedmates CONgress (spelling intentional) have fewer options every day. They can default totally on all USA Debts including your social security, military pay and pensions, welfare and all that.

ReplyDeleteThat would go well across the globe and in our country.

Heads on pikes, burning cities as EBT fails the Gimmie Dat's and whole nations refusing to do anything with us. Zero Trade on US Debts just cash or commodities on the barrelhead exchange. As much as we import daily PROVEN by the COVID Supply chain shortages chaos but much worse as flying in and secondary supplies also dry up.

Yeah, we CAN grow a lot here, but look at Florida right now. Thousands of hard-working line men from HOW many states working hard. What happens when THAT grid damage is from "Mostly Peaceful Rioters" across the country. All the grid runs through cities. All getting damaged.

How many BRAVE Linemen are going to walk away from their now undefended families to go into THAT Warzone to keep things going?

Or they can inflate with MOAR fake digits (cannot call them dollars as they are not but digits) to kick the can down the road "Funding" those debts-obligations and thus make the debt "Cheaper" by reducing the value of those digits.

Can you guess which option CONgress and the Fed choose? It's Wimpy's "I'll gladly pay you for a Burger on Tuesday if you give me one today" scam.

Pity the END of that Road is in view, so what to do?

There was a book called the Alpha Strategy that spoke about the wisdom of becoming your own "Bank" by buying now things that you need later. Far more complex but a two-year pantry of shelf stable foods. Kept in your own cool, dark dry, rodent (including noisy neighbors) free "Bank Vault" seems more useful than digits in a bank that might be defaulted or frozen by a "Bank Holiday".

Given the high likelihood that windows-roofs are going to get broken when bad things happen(tm) tarps with rubber ringed nails might be great for leaky roofs, plastic sheeting for replacing windows, maybe extra screen materials as not to "enjoy" biting bugs inside your humble abode and so on.

Look to Florida right now for ideas of good things to have in the garage. Safe water, shelter repairs, food and security tools and more.

Get busy the CAT 5 Financial Hurricane is nearby.

The ironic thing is that in the topsy turvy world of currency trading, the dollar is doing well. The Euro has fallen to the same value as the dollar and the Great Britain Pound has fallen to 90 US cents this morning. They've never been that low.

DeleteSince pretty much all of the western world uses fiat currency, it's like a toilet blockage when all the turds trying to drain out jam against each other and nothing flushes.

I have always tried to convert my "excess" money (that which does not directly pay for repeating monthly expenses) into physical assets and capabilities. Tools, spare parts, fabrication supplies, off-grid power, buildings and sheds, greenhouses and garden tools, food processing and storage equipment, the list goes on. Until I am completely in a position to live comfortably without interaction with the outside world, there are assets to acquire and things to learn (oh, another asset: printed books and reference material).

DeleteWhen you need one thing, get two. When you need something done, buy the tools to do it yourself. Acquire material stock. So far, these principles have served me well.

Right now is a very good time to purchase an item made in Europe. Say, a yacht.

DeletePerhaps the funniest thing about it all is that people are beginning to ask a simple question: "If the government can just create as much money as it needs, then why am I being taxed?" No coherent reply is possible.

ReplyDeleteWhen the contemporary international monetary system was created, it must have seemed really clever, especially politically. It would enable governments to "fund their dreams," without unduly burdening the citizenry with taxes. The core idea, of course, was that first-worlders regard debt obligations as sacred. We pay our debts and count on debts being paid, so basing money on debt is just as secure as basing it on a precious metal.

But we don't always pay our debts, do we? Especially the "we" that are called governments. And pretty soon, if my calculations are correct, we're going to experience the biggest debt-default in the history of Man.

Taxes aren't levied...at least at the Federal level...to generate income. They and the enforcement structure to collect them exist to facilitate the ONLY thing the vast majority of politicians care about. CONTROL.

DeleteMy take on MMT is that history is full of examples of people vying for power by telling the leaders what they want to hear, and the MMT folks are just another example. Their examples they quote all the time are so idiotic how could anyone other than a Brandon or an AOC believe them? "The carpenter can't run out of inches?" Seriously? He can sure run out of inches that matter, like inches of lumber.

DeleteI wish I could understand the notion of money/currency. If our money was still gold/silver backed, wouldn't that mean there is a fixed amount of money? Wouldn't that be detrimental to the economies of a nation with increasing populations? If you change the 'price' of gold to make more money available, isn't it the same thing as inflation? Perhaps the Biblical concept (since there is no proof of it ever occurring) of Jubilee is needed to correct our fiscal policies.

ReplyDeleteThat's a whole 'nother blog post and a big one at that. To begin with you're used to thinking of inflation as constant and prices always rise. In reality, there's an almost irrefutable iron law in manufacturing that says as quantity goes up prices go down. In a world with a commodity standard, prices tend to go down in time - of course with effects of things like shortages, "supply chain disruptions" and so on. Sometimes, the price stays the same but the quality of what you get goes up.

DeleteTo borrow a quote from an old blog post, "It has been said that an ounce of gold buys today about what it did at any point in the past. Stephen Harmston, former economist at Bannock Consulting, wrote that “across 2,500 years, gold has retained its purchasing power, relative to bread at least” which is seemingly proved when one considers that “It is said that an ounce of gold bought 350 loaves of bread in the time of Nebuchadnezzar, king of Babylon, who died in 562 BC” which is roughly what it buys today, a stretch of 2,500 years. With some judicious selection of the exact brand of bread, you get remarkably close to 350 loaves (and I'm sure there was some variation in what a loaf of bread cost even in King N's day). Likewise, you'll hear that an ounce of gold would buy a good toga and sandals in pre-Christian Rome, and buys a well-tailored suit and shoes today, or you'll hear that a $20 gold piece bought an 1851 Colt Single Action Army revolver, and today buys a good grade 1911. The point of all of these is that the price of gold is a standard by which other things can be measured. Sure, technology marches along and brings down the cost of some things, but most things that increase in price over the long term do so because the currency inflates."

Read this free book, learn how the federal USA has already defaulted on its fiat currency twice: https://mises.org/library/mystery-banking

DeleteI also like this book: https://en.wikipedia.org/wiki/How_an_Economy_Grows_and_Why_It_Crashes https://www.amazon.com/How-Economy-Grows-Why-Crashes/dp/047052670X

In an honest economy, at any instant there is a fixed amount of money, just like there is a fixed amount of oil or steel or concrete. Much of the point of "money" is to tell you when you can't afford to do something, like have more children, because you don't have money to support it with. Just like with building supplies, you can /make/ /money/. But, if you aren't using the money for its industrial purpose (like Gold to wire up computer chips), it doesn't matter what the absolute numerical quantity of money units is. Even if there is only one big stone coin, the decimal point on price tags can be adjusted to divide the total money up among the all the commerce currently occurring.

Anonymous, I read G.Edward Griffin's Creature from Jekyll Island. It explains that difference in ways that you will understand. He has quite a few YouTube videos. Very informative.

DeleteThe way I understand it, the price of gold, or rather, the number of FIAT dollars needed to bribe someone sufficiently to make them agree to sell you their gold, is dependent on the understood and agreed upon Value of the Dollar on that day. It's a damned shame that there is a Paper gold market. Maybe it's just my inner conspiracy theorist or maybe there is some truth to the notion that there are people who are willing and able to buy and sell In that Paper Gold market and keep gold from costing what it would cost in an unmolested market.

The inevitable result of, and therefore the purpose for, a debt-based mandatory national currency, is to enslave people. The founding lawyers already owned slaves of some national origins, but the Whiskey Rebellion tells us their goal was to make everybody a slave. The US Constitution was structurally similar to the British government of the time. The founding lawyers militarily displaced the British aristocracy to form a new American aristocracy. In the big picture, there isn't anything honorable about the political founding of the US, at all.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteIt's as bad or worse with gold as the benchmark.

ReplyDeleteThe dollar is worth about 1.4¢ in real terms compared to less than a century ago.

IOW, worth the cost in ink and paper to print it.

Yet people with assets denominated in fiatbux, paper or digital, think they're actual gazillionaires, for real.

"Weep and howl, ye rich..." indeed.

Excellent, excellent meme, and good analysis.

ReplyDeleteThe price of silver seems unnaturally steady, it is not inflating compared to other commodities. This seems a bit suspicious, is the silver market being manipulated in some manner?

ReplyDeleteThat has been alleged as long as I can remember. I don't have a definitive answer, but if it were true it sure wouldn't be shocking.

DeleteThere are very big buyers who trade silver futures and all forms of paper-silver that sometimes make the seller deliver the silver they signed for.

Yes, the silver market is being manipulated. The last I checked up on it (a few months ago), there was something like 20 times as much trade in silver certificates as there was physical silver to back up those certificates. As long as the music keeps playing, everyone can pretend there are enough chairs to go around...

DeleteThe US dollar is still viewed as "strong" and is depreciating more slowly than other currencies. Thus, the US dollar price of silver isn't rising as fast as one would expect.

Delete