As usual, I suppose.

Everyone is fussing over the exchange where Biden called Fox News reporter Peter Doocy a "Stupid son of a bitch." I wasn't aware until I read that article on a link from Divemedic's Area Ocho of what should really be the story there. First, from that article linked first here:

After Biden complained that all the press questions were about the military buildup around Ukraine, Doocy shouted, “Will you take questions about inflation? Do you think inflation is a political liability ahead of the midterms?”Thinking his microphone was turned off, Biden responded sarcastically, “No, that’s a great asset. More inflation.”

He added: “What a stupid son of a bitch.”

A bit later in the day, another link led me to this alleged Tweet from the White House that essentially says the same thing except with trivial word substitutions.

As is always the case with inflation, nobody "benefiting" from the new pay is a penny wealthier from it and very likely gets hurt by it.

I've done this analogy many times before, but maybe let's do it again for your friends or others who really think they're doing better because their paycheck is bigger.

Imagine for the moment that what I'm describing is legal instead of something that could get you put in jail. Imagine you could take a really "Magic" marker and just by doubling the printed value on the bills in your wallet, you actually made them double the "value." A $1 bill becomes a $2 bill. If you had a $2 bill it becomes a $4 bill (I know there is no such thing, but work with me here), a $5 becomes $10 and so on.

What I've always emphasized was the aspect that everyone else has the same marker and everyone else now has the same wallet, so relative to everyone else in the country your position hasn't changed even the littlest bit since everyone else doubled their income, too.

The unmentioned part is that every single expense in your life gets the same treatment because everything you buy is affected by the same doubling of costs. You make twice as much money but your food costs twice as much, your housing costs twice as much, everything has doubled. Has doubling the dollars you make improved anything in your life? Nope.

Those of us who were working adults during the crazy inflation of the 1970s know well that it can seem like everything just stays out of your reach as your pay goes up every time you're eligible for a raise. The last number I saw quoted for inflation over the past year was 7%. Shadowstats' calculation based on the same rules used in the Jimmy Carter days shows the year over year inflation to be 15% or 2.1 times the official 7%.

The Federal Reserve has said many times that they're committed to maintaining some inflation, basically because they're terrified of deflation, which they think will severely hinder the economy. They believe no one will buy anything other than essentials if they think it will be cheaper in the future. The unspoken corollary to that is nobody will save anything for the future if the money they save will be worthless in the future because of inflation, but they never seem to think that.

In my little analogy, you've just done conceptually exactly the same thing the Federal Reserve

Bank has done; you've doubled the number of dollars everyone has and

yet no one or nothing is better than before. In effect, you've reduced

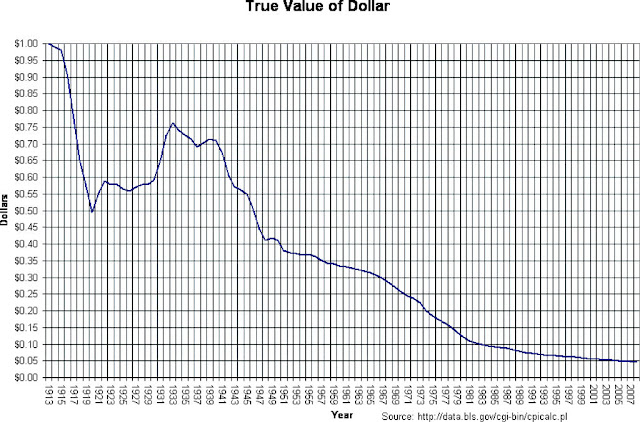

the buying power of the dollar in half. The Fed hasn't done a simple doubling of dollars, but they've been doing it since the Fed was created in 1913, 108 years. This chart of the buying power of the dollar is dated from 2007, but the trend downward has continued. It just needs to either be bigger, or use a logarithmic scale on the Y (vertical axis).

This says the buying power back in 2007 was less than a 5 cents in 1913 money. When people talk about gold or silver going up or down, they're thinking backwards. If gold is the "standard" the dollar is getting more or less valuable just like in that graph - although it has been a long time since the dollar went up in value, even briefly. I think it goes without saying, but I'll say it anyway, the price of precious metals is set on an open market, which inevitably means the price is a function of how much buyers value it. I'm not aware of a country in the world that actually uses a gold or precious metal backing for its currency.

It's worth asking who benefits from inflation? Let's say you have loans for a fixed amount of dollars, like a mortgage. If you have more dollars in five years because of inflation, your mortgage takes a smaller bite out of your pay. To the bank they're not losing money, that's budgeted income and as long as it comes in all is well. Any effects of inflation tend to be offset by new loans and other things (they sell mortgages to other companies all the time). The banks, and especially the bigger banks, benefit because they get those freshly created dollars before they have an inflationary effect on the market.

Finally, the ones who get the most benefit are the Federal Government. They sell bonds to finance all their expansionist crap and if they pay them back with inflated dollars, those are paid off. Their tax revenues, in numbers of dollars, go up if the revenue goes up by inflation. All of those promised payments they say they'll make (social security, medicare) that are tied to rate of inflation incentivize the Fed.gov cheating on the way they define inflation, which is why Shadowstats has calculations using the 1980 method and the 1990 method. For years, people have said that the only way our national debt will be paid off would be by inflating our currency. It seems to be a consensus that the debt is too big, and collapse is going to happen. Is going to be by fire (hyperinflation) or ice (death spiral into depression)? I've been writing about that since 2013 (second of two pieces by the same name). The Great Reset seems to play into what's going on, too.

A dollar value of 5¢ is rampant delusional fantasy.

ReplyDeleteAn oz. of gold traded at $20.67 in 1913, as it had for nearly a century prior.

(from 1837-1933 it was the official US price, and was the NY open market price of gold from 1839-1861, and again from 1879-1932, after the Civil War inflation hiccup ended).

That dollar with the spot price of gold at $1850/oz today, is worth 1.1¢, not 5¢. ($0.01117, to be excruciatingly precise). That's inflation, over 90 years, of 89,500%.

So the gov agency that put out that wrong graph is already lying about inflation by 500%.

That means a dollar in your pocket, from even as late as 1932, has now lost 98.9% of its actual value and buying power.

And the total lack of understanding of that reality has some guy over at Zero's trying to explain how his 12% average stock appreciation beats inflation and gold, with inflation running at 918% since 1970, and 89,500% to date since 1933.

The only way Wall Street can post illusory recockulous gains surpassing that of actual money, is by constantly discarding the multitude of stocks of failed companies in the DJIA that tank, year after year.

Because the DJIA can use hindsight to pick "winners", while investors have to use clairvoyance, at their own expense.

This is like letting the house bet against you on the roulette wheel after the ball drops.

Some people never got beyond third grade math, evidently, nor Fiscal Common Sense 101, but putting more zeros on the bills and moving the comma over on paychecks and stock dividend reports is genius on the part of TPTB, because Wall Street and the Fed have correctly sussed out that people are generally financial idiots.

BTW, the last time a US dollar was worth 5¢ was 2004 or so.

DeleteIt hasn't been worth 10¢ since 1978.

It dropped below 50¢ in 1969.

Stagflation killed 80% of the value between 1969-1978.

That was Tricky Dick, Jimmy, and 50 years of Dem congresses.

Then, printing money from air drove another 90% of the remaining value out from 1980-now.

And here you are.

Rome, England, Weimar, Zimbabwe, and Venezuela aren't just random examples of what happens when you debase the coinage.

They are the template.

And that should have been "8950% to date since 1933".

DeleteI slopped a decimal over too far.

I took Biden's comment as sarcasm when I first heard about it. After watching the video a couple times, I still think he meant it as sarcasm as he was muttering it. Considering the White House has been pushing that inflation was either non-existent or "transitory" for the past year, I think he's drinking the kool-aid (with whatever capacity he actually has left) and believes what the staff have pushed about inflation and that the so-called right-wing media is making stuff up to try to hang on the administration.

ReplyDeleteThe 'everyone shifts the decimal on their dollar bills' description of currency inflation isn't how it works. The early spenders of the newly printed currency, such as the government agencies congress spends money on like the pentagon, buy stuff at the old prices which haven't yet been adjusted upwards for currency inflation. The late spenders, such as middle class savers who spend their savings decades later in their retirement, buy stuff at the new prices which have been adjusted upwards in response to the inflation. They do not get to rewrite their dollar bills. If you save dollars for 20 years and then spend it after 10%/year currency inflation, its buying power has been reduced by 1.10^20 = 6.7275 times. The political purpose of currency inflation is to make it impossible for the would-be middle class to save for retirement.

ReplyDeleteThe way to crush the bourgeoisie is to grind them down between the millstones of taxation and inflation.

John Maynard Keynes, paraphrase of Lenin Interview

I'm still slowly plowing my way through The Coming of the Third Reich by Richard J. Evans. I'm quite certain that the author meant this detailed review of the German economy of the post-WWI period as a warning, not a play script; how to create anarchic chaos by misunderstanding the dismal science.

ReplyDeleteI don't entirely understand what is going on in the gold an silver markets. The price doesn't really respond in the way that it seems that it should due to inflationary pressures. (Because I don't understand why and when the market does what it does, I've only got a small amount as an inflationary hedge, rather than going all in like the goldbugs.)

ReplyDeleteIn contrast, the price of copper and steel (doubled at least since Jan 2021) is doing exactly what I expect it to do. (And dread. My parents work in an industry where they have to buy lots of that stuff.)

MadRocketSci

Everybody's got Au'n Ag. Purchased a couple of shares of PALL (and ingots) back around 6 years ago. I thought whenever Putin needed money, he'd sell some; whereas the flow out of S'frica remains a constant (in addition to the usual) to prop up the gummint there. IMHO, not much has changed since this was issued:

Deletehttps://pubs.usgs.gov/of/2012/1273/ofr2012-1273.pdf

Remember a few years ago when Germany asked for the gold back which the US had been storing for it since WWII, and the US told it, no it couldn't have it back? A week later, the US said yes, it could have it back, but it will take six months to deliver in several smaller shipments? A bank holiday suspending redemptions is the behavior I would expect to prevent a successful run on a bank which would reveal an empty vault, a full vault where many parties were told they own the same bars, or fake bars made with Tungsten cores. I think the price of gold and silver is kept down by fraud. All the big crooks are in on the scam, and the cartel has few enough members to police.

DeleteDr. Copper is the diagnoser of bad economies. No industrialization without electrical wiring.