For as far back as I can recall, if we went to talk about a European rocket launch industry there has been only one name: the European Space Agency or ESA. Likewise, when we spoke about European Rockets, we spoke about Ariane vehicles from the ArianeGroup in France. In the last dozen years, an Italian company named AVIO started providing Vega boosters to the ESA, and now the Vega-C. (Why do I want to say "New and Improved!" here?) Vega-C is set for its inaugural launch No Earlier Than July 13, and while the first Vega rocket flew in 2012, Vega-C increases performance from Vega’s 1.5 metric tons to about 2.2 tons to a reference 700 km polar orbit.

The situation has become more crowded in the last few years. Like everywhere else, it appears there's a rush of startup companies into the launch business in Europe. As you might expect, there's a wide range of capabilities among those companies, as well as a range of funding they've been able to raise. While there's a range of the mission capabilities they're pursuing, all of the newcomers are aimed at smaller payloads than the Vega-C - which is a much smaller payload than the Ariane 5 and coming Ariane 6.

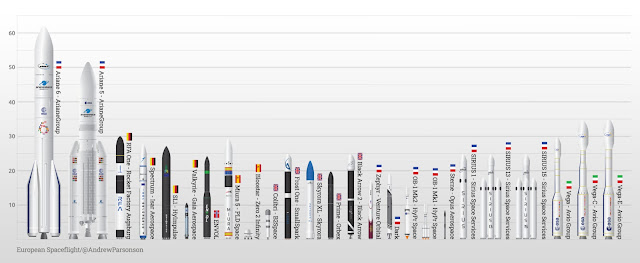

A website called European Spaceflight posts both a complete spreadsheet (complete with lots of numbers!) as well as a pretty cool graphic depicting all of these vehicles.

When I say lots of numbers, I mean things like how much funding they've claimed to have and the payload to a low earth orbit. Exactly what kind of LEO isn't declared for every launcher, and some companies don't even list a claimed payload for rockets they're designing. If the vehicle is for suborbital flights, the vehicle name has (sub) appended after it.

I was able to simply highlight the spreadsheet with my mouse and copy it into my

LibreOffice Calc spreadsheet. I won't bore those who don't care about

it, but here's the first 12 rows to give a feel for the data. European Spaceflight notes that funding figures

are sourced from Crunchbase or other public sources. For reference, a Falcon 9 lists its payload to LEO as 22,800 kgs. None of these vehicles are close to competing with it except the biggest version of the Ariane 6, called 64.

I was aware of a few of these startups but not even half of the batch; there

are 29 companies in that spreadsheet. It looks like the small launch business is turning into a global growth market, and spaceflight is starting to turn into what the visionaries said it would be in their predictions 50 years ago.

Bets: never. Too many regulations.

ReplyDeleteBets: Most will fall away unless seriously supported by governments as SpaceX has and will continue to radically lower the cost-to-space.

ReplyDeleteBut it's nice that someone in Europe finally got off their duffs and tried to do something.

While I applaud all the startups, just remember there were a lot of startup automobile companies as well...

ReplyDeleteI've been thinking we're heading for some sort of massive shakeout in the small launcher business, especially when I see small companies talking about launch prices that are more expensive than rideshares on a Falcon 9. I can see a smaller market for unusual/not routinely provided orbits, but not as many providers as we're looking at.

DeleteWhen Starship is flying routinely, if they get close to the cost per pound they're talking about, there can't be as many launch companies as there are now - even leaving out the startups.