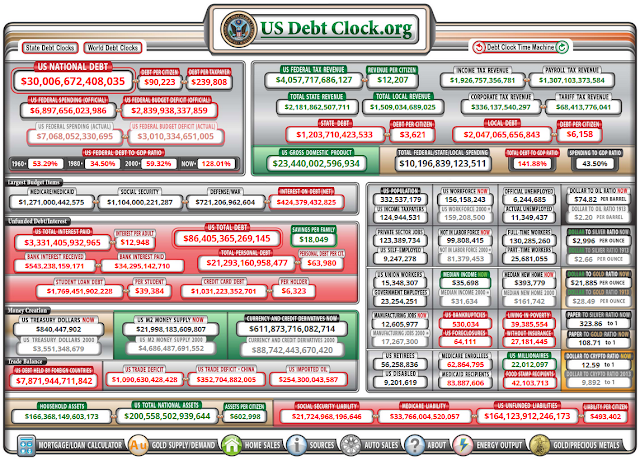

I wasn't watching closely enough to tell you day, hour and minute this

happened, but within the last month, the national debt of the US exceeded $30

trillion for the first time. The number as I write is the upper left box in the biggest font; for those who

think seeing all the numbers conveys the size better than just saying "the T word." From our friends at US Debt Clock.

When I saw the headline, I thought, "Gee, didn't I post on the debt going over $20 trillion in the blog?" Yes, I did and quite a bit more recently than I thought: it was in September of 2017. That feels recent to me because it's since I retired, on last working day of 2015. We went from $20 to $30 trillion in around four years and four months. Another way of looking at that is it took from the founding of the country in 1789 until 2017 - 228 years - to build up $20 trillion in debt and only four years and four months to build up 50% more debt.

Does that seem overwhelming?

We hit $15 trillion on November 17, 2011, which says the first $15 trillion in debt took 222 years and the second $15

trillion took 11 years. Yeah, I'm leaving out details on the months

here. I don't know about you but that makes me feel worse, not

better.

Getting back to the current $30 trillion number, The Peter G. Peterson Foundation points out that the total debt is bigger than the economies of China, Japan, Germany and the United Kingdom added together. When people talk about the Chinese funding our national debt, there's a little bit of truth there; I mean they have some amount of US bonds but no nation can buy more debt than their own entire GDP, they can only buy a few percent of it as bonds. In fact, China, Japan and the European Union are the biggest holders of our treasury bonds except for one buyer.

The biggest buyer of

the bonds to fund our government is ... us. More precisely, the Federal

Reserve Bank, which creates the money to finance our debt out of (thin air,

unicorn farts, whatever words you'd like). This would be like you

writing yourself a check to double your pay and putting it in your checking

account every payday. Except for the part about that one you wrote would

bounce to the moon and you'd end up in deep trouble. And if you listen

to the economic geniuses running the country, like AOC or

Dr. Stephanie Kelton, it's perfectly fine for a government to print all the money it wants.

Listen, I've posted on this topic many, many times, and I'm as tired of

writing about it as I'm sure most people are of hearing about it. Let me just put some brief highlights here:

- Yes, deficits and debts as commitments matter. We borrowed real money from real people both

here and in foreign countries, and we promised to pay it back. They

expect and deserve to be paid back with real money that's worth something. If the Fed inflates the dollar to

worthlessness, don't you think the Chinese, Japanese and the rest of the

world would be mad at us? Perhaps they'll abandon use of the dollar? Perhaps they'll just never buy another US bond? What if they demand something of value for their worthless currency, like maybe a national park?

- The government can't tax their way out of this. To heck with taxing the "richest 1%", if they confiscated, not taxed, the entire net worth of the 20 richest billionaires in America, they'd get $1.08 trillion. With spending at $6.9 trillion, the money would be gone in less than two months. In my opinion, the talk about "taxing the rich" they float is just to inflame class hatred and envy.

- Hauser's Law may be a really counter-intuitive thing, but it has been true for a long time. No matter what tax rates are, the tax revenues are roughly 19% of GDP. We just can't spend more than that consistently.

- No country with a Debt to GDP ratio much beyond ours has ever survived it as anything other than a walking corpse. Most have undergone economic collapse.

- If we truly intend to reduce that national debt, we not only need to cut out deficit spending, we need to run surpluses as far as the eye can see. Our great-grandchildren can think about deficit spending.

- No one in government has proposed spending cuts like we really need. Candidates in primaries have: Ron Paul proposed shutting down whole departments of the fed.gov hydra. Candidate Rick Perry proposed capping spending at Hauser's Law, which is more definitive about cutting spending.

- It truly is the spending.

Most people don't understand exponentials. We are in a phase that is

exploding toward infinity. It simply can't continue, that's

mathematically impossible. Worse yet, large segments of society howl

like they're being fed into a wood chipper if the fed.gov simply doesn't give them more every year, let alone actually cutting their free sh*t.

And this is why I think an economic collapse is inescapable.

Nothing is going to change, Congress is just going to keep on spending money they don't have. The rapidly increasing debt tells me we are going to hit $40 Trillion in another couple of years. Inflation will keep increasing. Eventually we will get hyperinflation. How long before then? Five years? Ten? Two? We are going to need a new currency. Look at Brazil and the Real: https://en.wikipedia.org/wiki/Brazilian_real#History

ReplyDeleteInterest on our debt is a little over 500 billion every month now.

DeleteWe'll hit 40 trillion in 2 years time.

A very well documented story is that we're being driven into the World Economic Forum's "Great Reset" as a way to restructure society more to the liking of some group of so-called (or self-described) elites. From the trajectory we're on and things like the similarity to Brazil, and the similarity to other collapsed empires, it's easy to conclude the dollar is done for.

DeleteThat means there's a need for a replacement currency or a return to more fiscal sanity but things we hear about don't seem to show that. It seems the WEF is still talking fiat (made up) money, but even more so. No cash. No barter. Everything will be done with a government controlled cryptocurrency so that everything you buy is tracked. No private property, no single family homes, no "family car" one could just pile into and go drive across the county. A level of control that the world's worst dictator wannabes have only dreamed of.

The bloodletting upon those "elites" for instituting that, or even trying, would be best described as "biblical".

DeleteAnd for reference, the entire U.S. budget never exceeded $500 billion in any entire year, prior to 1979.

DeleteEver feel like the Tidy Bowl man, but in the bowl instead of the tank? Just swirling around waiting for the bottom to drop out.

ReplyDeletePlot a graph of the federal deficit.

ReplyDeleteFlip it upside down.

Put a big red "X" at the spot that marks "You are here".

Now imagine it's a cliff you're sliding over.

All we're waiting for to see how far down the bottom really is, and to find out how jagged the rocks there are.

Government policy as that there is no gravity, and no bottom.

Or alternatively, that they will magically levitate.

Let's not forget what fraction of the budget is considered "non-discretionary." Even if we cut all of that - military, NASA, research foundations, etc. - it only reduces the bill by about a quarter.

ReplyDeleteWe will also need to stop the "non-discretionary" spending boom. Of course that will happen eventually even if we don't try now.

Sig, you present a very depressing but probably pretty accurate picture. The leadership has to been using different Economics textbooks than I used in college or even the finance class I had in high school. How the heck do they think this will work out?

ReplyDeleteIt's not just the US..... virtually every government/country on Earth operates at a deficit. It's just ours is the largest....with the proviso that China, being a closed society may in fact have a larger debt but won't publish accurate numbers. What cannot continue won't. The real question is what happens when the inevitable collapse happens. Whatever comes you can be sure it will be ugly. Very ugly.

ReplyDeleteEvery nation on Earth has bought the idea that they can deficit spend forever and money doesn't have to be "a store of value" - as the definitions say. There is Not One country on Earth that uses a commodity-based standard to set the value of their currency. It doesn't have to be gold or silver backed, or a "basket of currencies" or anything like that. In truth, if politicians behaved like grown ups and kept deficits down to a couple of percent of revenue, Keynesian economics would work. Only spend more than revenues in case of emergency. All we need are mature, responsible grownups running for office.

DeleteIn other words, we're royally screwed.

I've made fun of the MMT people and Dr. Stephanie Kelton many times, but the truth is that there have always been people in the "king's court" that will tell the King whatever he wants to hear to get benefits for them and their families. The MMT charlatans are just the 21st century version of a some officer reporting to the king trying to get more attention.

This comment has been removed by a blog administrator.

ReplyDelete