Brian Riedl of the Manhattan Institute took at look at some of the real numbers behind the story and the tax increases we've heard talked about are so short of funding this Green New Deal fiasco that there's no way anyone can think they're being serious.

There aren't many proposals that can really be looked at. AOC did that famous screed on TV about the marginal tax rate on any dollars earned above a person's 10 millionth dollar (the "tippy top") being taxed at 70%. We've heard about 90%. How much does it really cost? Jill Stein, the Green Party Candidate in the 2016 elections, proposed a “Green New Deal” costing between $700 billion and $1 trillion per year for public jobs and clean energy initiatives. But that's 7 to $10 Trillion over the next 10 years, which is clearly not enough spending for the Democrats today.

Instead, the plans that have been widely talked about come closer to $50 trillion over 10 years. Over and above the current deficits.

(W)hen assessing the needed tax revenues, a green-energy initiative costing $7–$10 trillion over the decade should be examined in the context of $42 trillion in additional Democratic-socialist proposals that include single-payer health care ($32 trillion), a federal jobs guarantee ($6.8 trillion), student-loan forgiveness ($1.4 trillion), free public college ($800 billion), infrastructure ($1 trillion), family leave ($270 billion), and Social Security expansion ($188 billion).Riedl then goes through some additional numbers. Let's start here. Let's not bother with taking 70% of income over $10 Million, let's take every penny of income over $1 million - you know they want to.

That 21 percent of GDP cost would double federal spending. And that does not even account for a baseline budget deficit rising to 7 percent of GDP over the decade — bringing the total budget gap to 28 percent of GDP.

Analysis of IRS data shows that this would raise 3.8 percent of GDP — not even enough to balance the current budget, much less finance a Green New Deal. And even that figure implausibly assumes that people continue working and investing. Slightly more realistically, doubling the top 35 percent and 37 percent tax brackets, to 70 percent and 74 percent for singles earning more than $200,000 and couples earning at least $400,000, would raise roughly 1.6 percent of GDP. That figure also ignores all revenues lost to the economic effects of 85 percent marginal tax rates (when including state and payroll taxes) as well as tax avoidance and evasion.Is he being reasonably accurate? I think so. A few years ago, I calculated if you took 100% of income for the "top 1%", which was around $300,000 at the time, you couldn't run the government for more than a few weeks. Bill Whittle said it well in this video. Even though it's dated 2011, I think the numbers aren't so different that the concept is worthless - it's within a factor of two.

Riedl does the same sort of disassembly of the current tax proposals as Bill Whittle talked through in that video (taken, BTW, from Iowahawk, whom I used to link to when he still blogged). There is simply no way to pay for this with "tax the rich" proposals; they need to raise taxes radically on everyone.

Writer Mica Mosbacher for Townhall adds a piece on Riedl's article and adds an important nugget of information.

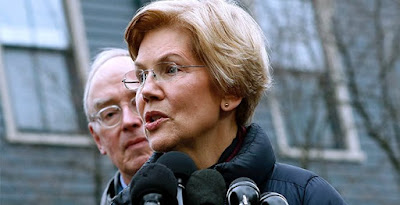

To make the math work, though, Democrats would have to revise their definition of “super-rich” to encompass pretty much anyone who can afford to pay their bills on time, which is precisely what Senator Warren seemed to suggest in a recent MSNBC interview about her wealth tax proposal.It's a clue by four when the candidate alludes to taxing everyone and her staff economists say her wealth tax falls pitifully, abysmally short of raising the funds she needs (not even .01% of it). If you haven't figured this out yet, when they say they're going to "tax the rich" and the corporations, they mean YOU. You may not consider yourself to be rich, but they simply can't make it work without taking everything from everyone.

“When we’re only taxing income, we’re taxing two people who may have the same income but are in wildly different economic circumstances,” Warren complained, making clear that the intention of her wealth tax is to punish people who manage their finances responsibly.

Yet, even Warren’s own economists estimate that her wealth tax would only bring in about $2.75 billion over 10 years.

We have to assume that's the plan.

(Tell ya what. AOC gets entirely too much publicity. Let's skip "bucktooth Betsy" and use Faux-cahontas for variety).

When "Tax The Rich" solutions come up, inevitably, everyone making anything like or above minimum wage suddenly find out government considers them "rich".

ReplyDeleteQED

This comment has been removed by a blog administrator.

ReplyDelete