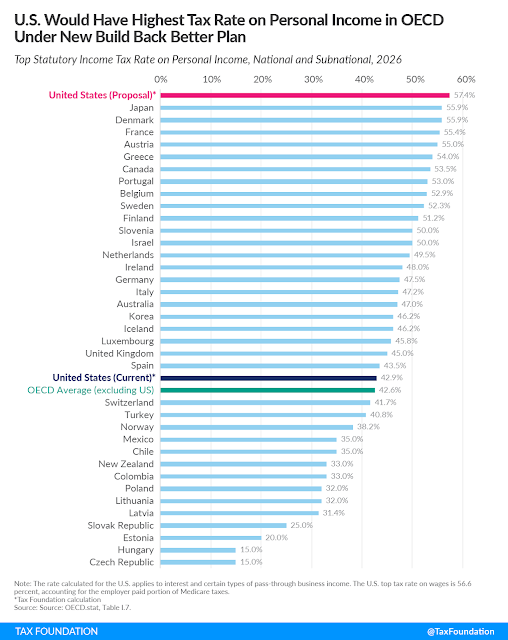

Yesterday, the Tax Foundation published an analysis of personal tax rates under the latest Democratic plan. The US goes from the low-middle of the group, better than average, to the worst income tax rate in the world.

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD). All 50 states plus the District of Colombia would have top tax rates on personal income exceeding 50 percent.

They publish this list of maximum income tax rates in OECD. The US would go from 16th lowest (best) to the worst income tax rate.

They explain:

High-income taxpayers would face a surcharge on modified adjusted gross income (MAGI), defined as adjusted gross income less investment interest expense. The surcharge would equal 5 percent on MAGI in excess of $10 million plus 3 percent on MAGI above $25 million, for a total surcharge of 8 percent. The plan would also redefine the tax base to which the 3.8 percent net investment income tax (NIIT) applies to include the “active” part of pass-through income—all taxable income above $400,000 (single filer) or $500,000 (joint filer) would be subject to tax of 3.8 percent due to the combination of NIIT and Medicare taxes. Under current law, the top marginal tax rate on ordinary income is scheduled to increase from 37 percent to 39.6 percent starting in 2026. Overall, the top marginal tax rate on personal income at the federal level would rise to 51.4 percent.

Their cited top tax rate of 57.4% includes Federal, State and Local income taxes. In the states that have income taxes, the average top marginal state-local tax rate is 6.0 %. That 6% is added to 51.4% they quote in the above paragraph giving that 57.4 %

percent. There are eight states that don't have an income tax, and the top income

tax in our states would be that 51.4%. Feel good if you want, but it's

still higher than all but the 10 worst tax rates in the civilized

world.

This

assumes the deduction for state and local taxes remains capped. If that cap were to be removed, the top income tax rate would fall to 54%.

You might have heard about the US pushing on the rest of the world to establish a minimum tax on businesses. The reason for that move is that they intend to push those taxes in the US and they don't want US businesses to move to other countries for the lower tax rates. I can hardly think of an easier sell than telling a bunch of other countries, "let's all raise taxes." If another country wants to lure American businesses there, I'm sure there are plenty of other incentives they can dangle.

Further, this analysis doesn't include the worst tax I've heard of, the "wealth tax" that would charge taxes on income that hasn't been paid. Since we don't have text of a passed bill, I'm not going to look up the details that might change. Plus, since it's not actually income and hasn't been earned or paid, it's doubtful that such a tax is constitutional. That said, the idea is that most of the on-paper wealth of the billionaires they detest so much (but whose money they want so much) is in stocks they own. The tax will be based on their stock shares having gone up in value, even if the owner hasn't sold any shares and made no income. Details like how the value of those unsold stocks is to be determined - or (most likely, IMO) on what date the stock value will be assessed - aren't available. Nor has anyone said if the stocks go down in value if those billionaires will be reimbursed.

This last one reeks of the absurdly childish view the Stupid Party voices all the time that billionaires are Scrooge McDuck, swimming and playing in vast piles of gold coins, gems, and other material wealth.

Funny, but isn't this exactly what all of us and Trump were saying would happen if Fumbles McPuddingBrains McPoopypants took over, or was selected, or was installed during a stolen election?

ReplyDeleteYeah... 81 million real votes my ass.

And that's just the taxes - it doesn't include the rest of the spending . . .

ReplyDeleteAlmost like they want the torch-and-pitchfork crowd to roll out the tumbrel carts.

ReplyDeleteThey left seized power and have ZERO intentions of ever relinquishing it. They want ALL of our wealth....every last dime. And they intend to take it. Pseudolegally at first...then by brute force. They aren't even trying to hide what they did, are doing and intend to do. They believe they are now unassailable and untouchable. Till we prove that belief wrong they have no incentive to cease their criminality, their assaults on our freedoms and their efforts to destroy America.

ReplyDeleteTINVOWOOT.

DeleteNote that they do not intend to do anything to their owner - George Soros!

ReplyDeleteA likely unconstitutional wealth tax may yet get passed by the democrat-communist party and their RINO friends. They are unconcerned about issues of constitutionality, and the courts aid and abet them. It would take years if not decades for the issue to get decided in courts, and you can bet the taxes collected illegally during that time would not be refunded.

ReplyDeleteThis country needs a "second degree treason" law that would ban for life any politician who voted for (or signed) a law later found to be unconstitutional. No prison term or fine, just a lifetime ban on elected office. Make them honor their oath of office!