The endless talk about the debt ceiling and "default" would try the patience of a saint, and I'm not one. It's about as riveting as watching paint dry, but way more terrifying because they're bargaining away our futures, and the futures of everyone we hold dear. Plus we hear things like the "

Gang of Six" proposal and people react as if it's a "done deal" when it's just someone's proposal. So let's go over some of the fundamental truths. Chances are we all know these on some level, but I'm putting it in one handy place to remind my family of it all.

To begin with, it's hard to know if the August 2nd date is real or not. It doesn't matter if it's 2nd or the 15th - we are going to hit our debt ceiling at some point because spending is way beyond what revenues support. We are borrowing roughly 43 cents of every dollar we spend, so when they run out of ability to borrow, 43% of the budget collapses.

Note that

not being able to borrow is not default.

Economist John Lott, who most of us know as the author of "

More Guns, Less Crime", wrote this critical analysis, "

Seven Myths About the Looming Debt Ceiling 'Disaster' " about a week ago. The fact that hitting the ceiling is not default is myth number 1:

Not increasing the debt ceiling only means that the government can't borrow more money and that spending is limited to the revenue the government brings in. And, with interest payments on the debt making up less than a ninth of revenue, there is no reason for any risk of insolvency.

Time after time, congress and the president have failed to agree on a debt ceiling increase and still there has been no default. Examples include: December 1973, March 1979, November 1983, December 1985, August 1987, November 1995, December 1995 to January 1996, and September 2007.

You should RTWT. Lott, as always, brings the logic and fact to the story, which is currently so full of flaming rhetoric that it's almost impossible to listen to.

Since all of the spending and revenue is public information, it's relatively easy know how much revenue is expected. You will hear something like $200 billion, which is the annual revenue average per month;

Denninger uses figures from Bloomberg that say August is a relatively low income month, and it will be somewhere around $150 to $170 billion.

Here we go, assuming we have $150 billion (I'm a pessimist) in revenue to spend.

First, there's what we must pay. That's $29 billion in interest. We have $121 billion left. Everything else is, legally, a choice.

...

We will not default in August, unless Treasury intentionally spends the money that they are legally required to pay in interest on the equivalent of "hookers and blow" instead. (emphasis in original)

They can assign priorities - and if Congress doesn't the President will.

I believe that means this President would pay the EPA and HUD to stay at work and not pay the military (i.e., "hookers and blow"), whereas you and I would pay the military and shutter the EPA, HUD, DoE and more (not to mention sending Holder and his pegboys at BATFE to the Mexicans who would like to... thank him for Gunrunner). If you think Obama would do otherwise, you're more impressed with him than I am. He's threatening to destroy anything he can to keep the spending he so dearly loves.

As Kerodin put it:

There is nothing meaningful in these debt/deficit discussions, but for the reinforcement that the Establishment and their supporters encompass a very large body of Americans and they have zero interest in genuine Constitutional values. They want the Constitution out of their way, and they have taken the decision to burn the republic to the ground to get their way. (emphasis added)

While I might dispute that the arguing in DC represents "a very large body of Americans", clearly, the

administration doesn't feel there are any drawbacks to continuing spending. While you get the feeling of austerity planning, if not the actual phrase from the Tea Party-led crowds, it never leaves the lips of the evil party. To them, it's "laissez les bon temps rouler". Mark Steyn,

in this piece in the OC Register, says:

The word has become so instantly ubiquitous that Leftie deadbeats are already opposed to it: "Austerity Protest Takes Place In Dublin." For the rentamob types, "austerity" is to this decade what "Bush" and "Iraq War" were to the last. It can't be long before grizzled old rockers are organizing some all-star Rock Against Austerity gala.

By contrast, nobody seems minded to "speed austerity measures" over here. The word isn't part of the conversation – even though we're broke on a scale way beyond what Ireland or Portugal could ever dream of. The entire Western world is operating on an unsustainable business model...

We are, as Steyn says, the brokest nation in history, but only a small number of elected officials seem to care. To most, this whole "debt ceiling" bit is a charade; after all, every other time in history the question has come up, the ceiling has been raised, so for all intents and purposes, it doesn't exist at all. They criticize Paul Ryan for having a plan, but the evil party hasn't proposed a single plan of their own. They just want to blame the stupids for everything that's wrong. Back to

Steyn for a moment (and you should RTWT):

Obama has done his best to pretend to take them seriously. He claimed to have a $4 trillion deficit-reduction plan. The court eunuchs of the press corps were impressed, and went off to file pieces hailing the president as "the grown-up in the room." There is, in fact, no plan. No plan at all. No plan whatsoever, either for a deficit reduction of $4 trillion or $4.73. As is the way in Washington, merely announcing that he had a plan absolved him of the need to have one. So the president's staff got out the extra-wide teleprompter and wrote a really large number on it, and simply by reading out the really large number the president was deemed to have produced a serious blueprint for trillions of dollars in savings. For his next trick, he'll walk out on to the stage of Carnegie Hall, announce that he's going to play Haydn's Cello Concerto No 2, and, even though there's no cello in sight, and Obama immediately climbs back in his golf cart to head for the links, music critics will hail it as one of the most moving performances they've ever heard.

The only "plan" Barack Obama has put on paper is his February budget. Were there trillions and trillions of savings in that? Er, no. It increased spending and doubled the federal debt.

What else do you think that whole charade about "I can't promise social security checks will go out" was all about? Or the Paul Ryan-esque clone pushing grannie's wheelchair over the cliff? Nothing but political gamesmanship aimed at keeping control over the throttle.

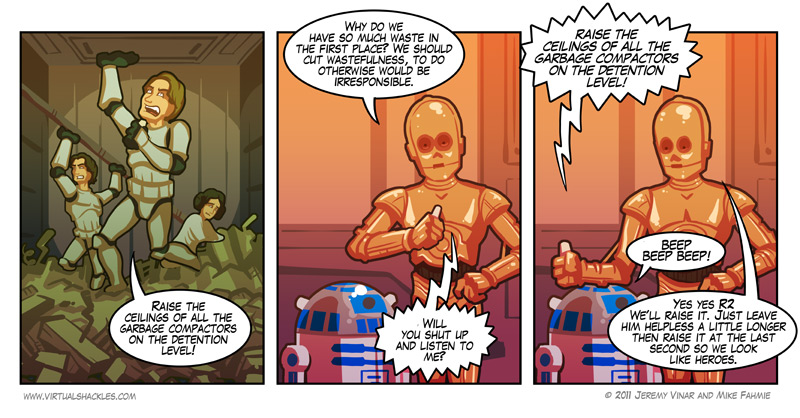

While a better illustration might be Nero fiddling while Rome burns, this one does have a more realistic feel to it. (The only issue I have with this cartoon is a subtle implication that

the elephant is driving; a better caption would be "What do you mean

"turn"? I thought you were steering.") Or, as Steyn concluded,

In the debt-ridden treasuries of Europe, they're talking "austerity." In the debt-ridden treasury of Washington, they're talking about more spending (Kathleen Sebelius is touting new women's health programs to be made available "without cost."). At the risk (in Samuel Johnson's words) of settling the precedence between a louse and a flea, I think Europe's political discourse is marginally less deranged than ours. The president is said to be "the adult in the room" because he is reported to be in favor of raising the age of Medicare eligibility from 65 to 67.

By the year 2036.

If that's the best offer, there isn't going to be a 2036, not for America. As the Europeans are beginning to grasp, eventually "political reality" collides with real reality. The message from a delusional Washington these last weeks is that it won't be a gentle bump. (emphasis added)

Everyone has, and is entitled to, their opinion of how the world will play out if a deal isn't reached. I lean (as usual) to the non-mainstream view that raising the debt ceiling

without concrete plans for spending reductions is

the worst possible outcome. We may not need an actual balanced budget amendment to start circulating, but if we don't end up with a path to much less borrowing, that's when the dollar collapses. A temporary rise in the ceiling would be accepted by the markets if there was a solid plan for reducing it again. If we

don't even produce a path to lower deficits, less spending and fiscal sanity, we've proven our political process is incapable of fixing the republic and the US is not worth the credit rating it has. That's when the dollar goes Zimbabwe.