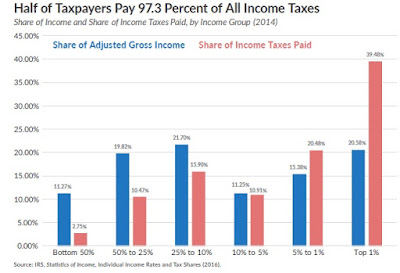

The easiest fallacy to address is the "tax cut for the wealthy". Dollar wise, any tax cut is going be mostly for the wealthy because they pay the vast lion's share of taxes. According to the Tax Foundation's 2016 Update,

The top 1% of incomes earned 20.58% of all the adjusted gross income (AGI) reported to the IRS, and paid 39.48% of all the income taxes collected. Graphically easy to see (Excel spreadsheet from the IRS):

- The top 1 percent paid a greater share of individual income taxes (39.5 percent) than the bottom 90 percent combined (29.1 percent).

- The top 1 percent of taxpayers paid a 27.1 percent individual income tax rate, which is more than seven times higher than taxpayers in the bottom 50 percent (3.5 percent).

The top 1% had an income above $465,626. Furthermore, the top 5% to 1% and the top 1% put together reported 35.96% of all the AGI reported and paid 55.46% of all taxes. The bottom 50 percent of taxpayers (those with AGIs below $38,173) earned 11.27 percent of total AGI. This group of taxpayers paid approximately $38 billion in taxes, or 2.75 percent of all income taxes in 2014.

The next complaint is that the proposed reduction of the top corporate tax bracket from 35% to 15% is a "giveaway for corporations". Corporate income taxes are usually regarded as double taxes, since the same income is taxed once as profit, and once as individual income when distributed as dividends to shareholders. Since the dollars that made up those sales that turned into profit were from after-tax income from consumers, you could argue that income is taxed three times. Contrary to popular misconception, the burden of corporate income taxes isn't paid by corporations, but is instead paid by workers, shareholders and consumers. Corporations act more to collect taxes than to pay them. People crying to tax corporations are really asking to tax themselves, but few understand that.

Finally a few words on how reducing taxes will "affect the deficit", "CBO scoring", and similar nonsense. Tax revenues are not the same as tax rates; the two are related, but it has been shown several times that leaving more money in consumer's pockets affects if and how they spend, and cutting rates can increase revenues. CBO scoring is based on the assumption that spending and attitudes are constant. Likewise, I don't put the slightest bit of faith in numbers projected for any budget item out 10 years. I'm not even sure they're even a general guide of what to expect. I always say to go back 10 years and look at what was projected for now. They never get it right.

Is it a good plan? As far as I can tell it isn't a plan, yet. It's more of an outline for haggling to start. Will it help the economy? I don't know. Some will win, some will loose. I'll keep an eye on it.

So long as roughly half Americans pay no federal income tax, any tax cut is designed to help the wealthy. Good call on that one.

ReplyDeleteTo me it's the business tax rate that will spur growth in the economy. I don't expect all that much change in my income tax.

It is not just income tax either. Anyone who has run a business also pays half of the S.S. tax, along with unemployment tax and a myriad of other taxes. Obamacare tax anyone? It is time to wrestle some of the out of control taxation to the ground and bury it. indyjonesouthere

ReplyDeleteAnother thing the whiners don't get is that their pay is reduced by the SS Tax, unemployment tax and all the rest - including the Obamacare tax.

DeleteThe tax system is used for social engineering as much as (or more than) for income generation.

Just more proof that the whiners don't understand How Things Work. At 35-40% fed (plus whatever's at the state and local levels) there's strong incentive to find a work around, from renting a Congressman through business "restructuring" to simply "under the table." Which is why we have the tax code we have. At 10% it's cheaper and simpler to just pay the tax.

ReplyDeleteUntil we nuke the tax code - and by "nuke" I mean a large, smoking crater - and replace it with something so simple it can't be mucked with and at a rate so low it wouldn't pay to muck with it in the first place - we'll be at the mercy of the liars, cheats and thieves in D.C. who use it to buy votes.

The best part about his plan, and what the Communists hate the most but dare not talk about, is that it eliminates the deduction for state income taxes. The fine folks in Communist states that tax income currently get to deduct that tax from their income. Which means that Federal tax bills in Taxachussetts and New Yawk and Mexifornia are going up significantly!

ReplyDeleteHallelujah!!!