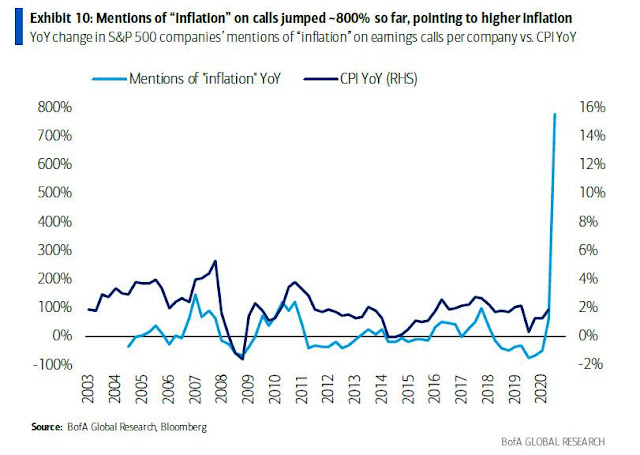

Zero Hedge had the story this morning that ought to send chills up all of our spines. The setting is that the Bank of America has earnings calls with many businesses they work with (as you'd expect), and they note the number of mentions of "concerns about inflation" they hear mentioned. In their first calls in the previous two weeks, the number of mentions of concerns was up 400% year-over-year (YoY). That was more than triple the YoY per company so far, the and the biggest jump since BofA started keeping records in 2004. This week they needed an even bigger chart. The YoY increase in mentions of "concerns about inflation" reached 800% YoY shattering the week-old record.

BoA issued an oddly-worded message in a report, which ZeroHedge presented and I'll repeat:

What exactly does transitory hyperinflation mean? Haven't all episodes of hyperinflation been transitory? Weimar Republic, Zimbabwe, currently Venezuela... Countries undergoing hyperinflation either restructure their economies (usually several times) to end it, go to war, or they collapse (or some combination of those) right? In the broader sense, isn't everything that happens in the world transitory?

I find this an interesting time to post this due to the posts this past weekend by both Bayou Renaissance Man and Area Ocho about inflation showing up everywhere now. I did a post about inflation being here on April 2nd (although my intent was to ridicule Modern Monetary Theory) and included a graphic from Reddit with a summary of inflation numbers.

There's advice for dealing with inflation virtually everywhere. If there's something you need and you believe your income prospects are not likely to be destroyed, it's cheaper now than it will be next week, next month or next year. Yes, that means stockpile food and supplies while you can. Yes, that argues to buy anything now, something which can act to further push up prices (not to mention that I don't want to start another run on toilet paper, or any sort of food). Back in the raging inflation of the '70s, when the dollar was in free fall due to getting off the gold standard for good, it was pretty commonly said that if you needed something you might finance, like a car, not only would the car be more expensive soon, but you'd be paying it off with dollars that were worth less to you if your job held up. (Many of us remember getting the maximum raises our employers would pay for years in the '70s).

Is this the final push to destroy the US or just the idiocy of virtually doubling Federal Spending and going to extremely deep deficits? Maybe it's just that the economics of the last four thousand years are more right and Modern Monetary Theory is going to cause a total collapse? Got me. From the practical standpoint it just doesn't matter very much.

Just keep an eye out, keep your head on a swivel, and be careful.

BoA issued an oddly-worded message in a report, which ZeroHedge presented and I'll repeat:

What exactly does transitory hyperinflation mean? Haven't all episodes of hyperinflation been transitory? Weimar Republic, Zimbabwe, currently Venezuela... Countries undergoing hyperinflation either restructure their economies (usually several times) to end it, go to war, or they collapse (or some combination of those) right? In the broader sense, isn't everything that happens in the world transitory?

I find this an interesting time to post this due to the posts this past weekend by both Bayou Renaissance Man and Area Ocho about inflation showing up everywhere now. I did a post about inflation being here on April 2nd (although my intent was to ridicule Modern Monetary Theory) and included a graphic from Reddit with a summary of inflation numbers.

There's advice for dealing with inflation virtually everywhere. If there's something you need and you believe your income prospects are not likely to be destroyed, it's cheaper now than it will be next week, next month or next year. Yes, that means stockpile food and supplies while you can. Yes, that argues to buy anything now, something which can act to further push up prices (not to mention that I don't want to start another run on toilet paper, or any sort of food). Back in the raging inflation of the '70s, when the dollar was in free fall due to getting off the gold standard for good, it was pretty commonly said that if you needed something you might finance, like a car, not only would the car be more expensive soon, but you'd be paying it off with dollars that were worth less to you if your job held up. (Many of us remember getting the maximum raises our employers would pay for years in the '70s).

Is this the final push to destroy the US or just the idiocy of virtually doubling Federal Spending and going to extremely deep deficits? Maybe it's just that the economics of the last four thousand years are more right and Modern Monetary Theory is going to cause a total collapse? Got me. From the practical standpoint it just doesn't matter very much.

Just keep an eye out, keep your head on a swivel, and be careful.

Is this the final push to destroy the US or just the idiocy of virtually doubling Federal Spending and going to extremely deep deficits?

ReplyDeleteI think the first part of that question is the primary underlying reason with the second part the way Democrats have always been in my lifetime. "Modern Monetary Theory" is just another cover by the Elites to destroy both the U.S. economy as well as the World economy in an effort to instantiate their "Great Reset".

X2

DeleteNeed moar gold.

ReplyDeleteWith the price of building materials what it is and where it's going, should I sell dismantle my house and sell the parts?

ReplyDeleteI'm wondering the same thing ...

Deletebe like an auto stealing gang. the parts are worth more than the whole.

Delete"Is this the final push to destroy the US..."

ReplyDeleteYes.

I agree boron. They however will get what they wish for, and transitory is a FED RESERVE code word.

DeleteThat copper inflation is a HUGE hair off. I follow it semi regularly and it was 2 bucks not to long ago now over 4

I've heard that the lumber price increases were temporary due to the Covid crap and would return to normal when workers returned. If that's the case, why would a bank lend money on an overpriced house (due to temporary lumber price increases), without requiring a hefty down payment to cover that increase. Since they don't, we can assume these rising prices are here to stay.

ReplyDeleteI'm sorry, but I am having just a wee bit of a problem with these two words being used together by someone with functioning brain cells:

ReplyDelete"Transitory Hyperinflation"

I lived through the Carter years that was so bad they invented a new term to describe it:

"The Misery Index"

And even though we made it through those tough times it took YEARS to recover. There wasn't anything "Transitory" about that Misery.

But as bad as it was, the self inflicted wounds our economy, society and Country are enjoying right now will make us look back on the Carter years with envy.

I wonder if that is why the oversized potato and Camel Harrass are pushing their picture that they took in Carter's living room.

MSG Grumpy