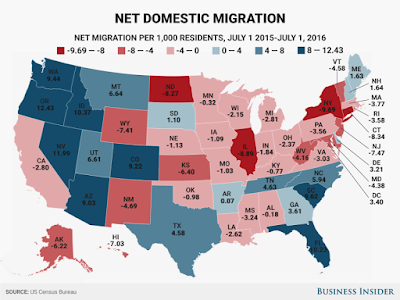

While other factors are involved, it's pretty clear that states with high tax rates like New York, Illinois, and New Jersey for instance were subject to a lot of movement into states with lower tax rates like Florida (no income tax, at least), Tennessee, Arizona and South Carolina, but there's other stuff going on here as well. The entire Midwest had net outward migration, but so did New Mexico and the old deep south: Louisiana, Mississippi, and Alabama. California only losing 2.8 people per thousand residents (PPT) surprised me.

This map was only for the period of July 1, '15 to July 1, '16, though. Virginia lost 3 PPT but after Virginia (and the DC suburbs) already had become one of the richest areas in the country and before the Trumpening so probably not related to government. North Dakota lost 8.27 PPT, which is a lot, but late 2015 was the time of the North Dakota oil bust. In the broader sense the pattern of tracking highest tax rate states holds, though. Between July 1, 2016, and July 1, 2017, nearly 450,000 people moved out of New York, Illinois and California. That said, Oregon, Nevada, Colorado and and a few others surprise me. Perhaps it's Californians moving someplace more like home than others, but

Hearing talk about the new Trump Tax Plan has gotten me thinking if we're likely to see more movement between states to reflect capping the tax deduction for state and local taxes at $10,000. The lower cap will have the effect of making it mean more to middle income than high income taxpayers. Obviously, if a family's SALT (State And Local Taxes) are under that limit, they have less incentive to move to escape the burden than a family that might owe quite a bit more than $20,000 in SALT.

Of course, something you'll never hear Chuckie Schumer, Nancy Peloski, Andrew Cujo or any other politician from a high tax state is that the rest of the country's taxpayers are subsidizing their spending by paying for the SALT deductions. Florida and Texas taxpayers are paying for the mortgage interest deductions of people living in $750,000 dollar homes in California counties where that's the median house price. We're all paying each other's taxes and not just our own. There's no better argument for a flat tax/fair tax approach.

I have yet to come across anything of sufficient detail on the new Tax Cuts and Jobs Act that I feel comfortable commenting on it. I've seen several apparently-trustworthy pieces that list "typical families' tax situations", but those are hard to digest. See the Tax Foundation's analysis and another version from the Heritage Foundation. It seems to me that cutting taxes while not creating "tax cuts for the rich", which is going to be the cry no matter the reality, is a tough needle to thread. It seems like they did a pretty decent job of threading that needle. Let's face it, the lowest 50% of incomes pay about 3% of federal income tax. The rich pay the lion’s share of the tax burden, so they will see the largest dollar value in benefits. I think the Heritage Foundation has a pretty good look at the truth in a piece on 5 Myths About Tax Reform and Why They're Wrong:

Myth 1: This is just a tax cut for the rich, and it will actually raise taxes for everyone else.It seems to me this will lead to some movement across state lines, but it's hard to know if it will have the effect of making mass movements. There could be an uptick in housing sales because of this law, though.

The truth is in fact the opposite. The Senate tax bill increases the amount of taxes paid by the rich and, according to the liberal Tax Policy Center, 93 percent of taxpayers would see a tax cut or no change in 2019. They found similar results for the House bill.

Both tax bills would actually increase the progressivity of the U.S. tax code. That means fewer people at the bottom will pay income taxes, and people at the top will see their share of taxes paid increase.

The Cato Institute’s Chris Edwards notes that the Senate tax bill cuts income taxes for people making $40,000 to $75,000 a year by about 37 percent. People making over a million dollars see a cut of only 6 percent.

In two recent Daily Signal pieces, we calculated how 12 different taxpayers would fare under each of the tax plans. The results show that almost everyone will see a tax cut, and only the wealthiest families are at risk of their taxes going up.

Under the current tax code, the top 10 percent of income earners earn about 45 percent of all income and pay 70 percent of all federal income taxes. The U.S. tax code is already highly progressive, and these tax reforms will only increase the trend of the wealthy paying more than their share of income earned.

There will also be a downtick in the quality of government in the receiving areas. Our fine friends migrating out of the Blue sewers bring their politics with them. And that includes the vote fraud. Add in the Puerto Ricans scrambling off that ship and bringing THEIR politics with them, and things do not look good for Florida. Nor for any other state which is "blessed" by this population transfer...

ReplyDeleteThe other day, I was looking at some site saying Texas would be a blue state by 2030 ('35?) based on the demographics of the hoards of Mexican and Californian immigrants. While I steadfastly maintain nobody accurately predicts the future that far out, it's interesting and agrees with what you're saying.

DeleteMuch like the fuss about the Congressional Budget Office scoring about this (and any) bill: what exactly have they predicted correctly?

This one:

Deletehttps://giphy.com/gifs/3o6Zt6piveU7GjDQnC

with linky from Western Rifle Shooters:

https://westernrifleshooters.wordpress.com/2017/12/27/badthink-texas-edition/

???

Probably that one, yes.

DeleteThe "tax cut for the rich" meme is part of the Democrat/socialist election strategy and always has been. It depends upon a lot of uninformed people who resent anyone having more than them. In this instance the left is conflating "the rich" with corporations. Perhaps corporations are an even better target for the left than the actual rich (especially since so many of our rich today are in fact leftists). But it is the classic case of cutting off your nose to spite your face. I assume most Democrat politicians are not stupid and know at least a little about economics and thus know that tax cuts for corporations and unincorporated businesses will lead to a better economy and jobs for those who really need them. It is incredibly cynical and destructive to push the anti-tax cuts to the rich meme simply to get reelected knowing full well that it leads to direct and palpable harm to the very citizens/voters the left claims to care about. But what the hell... It works, Democrats will get elected on this anti-rich pap and the poor and middle class will suffer because of it. It is the natural evolution of a democracy that the majority uninformed voters will vote to take money from the "rich" for free stuff to the lazy and kill the goose and squander the golden eggs. The Democrats need the economy to crash before the 2018 election. I think it is likely they will be able to do that.

ReplyDeleteThere have been academic papers written about this. See, for example, the Curley Effect (pdf warning). Destroying the city and voters to maintain power.

DeleteI agree that changes in tax policy change total tax collection. However, I think the larger shift is between who pays how much taxes, which is zero-sum. There exists no objectively best answer about this distribution of taxes satisfactory to everyone, because it's a tug-of-war.

ReplyDeleteThe bottom line is from the Heritage article, quote above,

DeleteBoth tax bills would actually increase the progressivity of the U.S. tax code. That means fewer people at the bottom will pay income taxes, and people at the top will see their share of taxes paid increase.

The income tax has become a parody of itself. A smaller and smaller percentage of the population pays more and more with every tax law change. As Thomas Sowell says, "I don't understand how wanting to keep more of what you earn is greedy, but wanting more of someone else's earnings isn't".

The Sowell quote suggests there is no income tax arrangement which isn't a parody of its sales pitch. The income tax arrangement in the first year of the income tax was wrong, and it's never been right.

DeleteThen there is "The Corp tax reduction is permanent. The other cuts resume at a future date."

ReplyDeleteBS. The next Congress that decides to raise the Corp rate, and has the votes to do it, (Or a Crisis!), Will.

2018 will be our first full year out of Kalifornia, so next year will be most interesting for us.

ReplyDelete